Sen. Elizabeth Warren on Monday renewed her push for an “ultra-millionaire” tax, reviving the proposed wealth tax that defined her own White House campaign to make the case that President Joe Biden could use it to finance his broad economic agenda.

As the Senate takes up the $1.9 trillion coronavirus relief bill passed by the House last week, with a provision to raise the hourly minimum wage that is expected to be stripped out, the White House and Democratic lawmakers are already looking ahead to Biden’s “Build Back Better” plan that is expected to be used as a vehicle to update infrastructure and create jobs, including in clean energy.

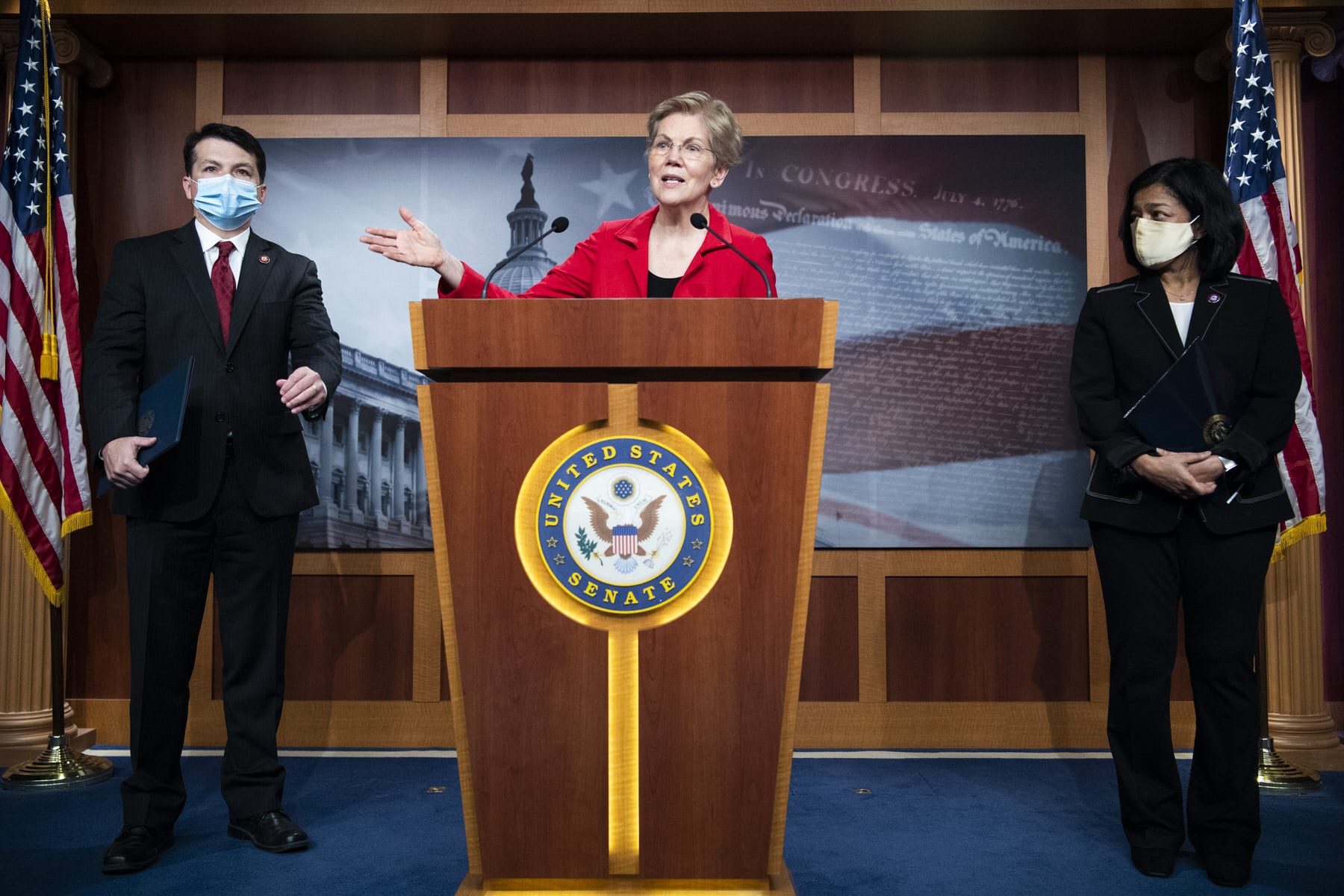

During the Democratic presidential primary, Biden did not support a wealth tax like the one offered by Warren and other progressive-leaning lawmakers such as Reps. Pramila Jayapal of Washington and Brendan Boyle of Pennsylvania, who are spearheading the effort in the House. The introduction of the proposal could mark the first notable policy conflict between Biden and the liberal wing of the Democratic Party if the administration does not consider it.

“It is time for a wealth tax in America,” Warren told reporters on Monday.

She added that a wealth tax would “level the playing field a little bit and create the kind of revenue that would allow us to build back better, as Joe Biden says.”

The proposal unveiled by Warren, Jayapal and Boyle, which mirrors the one detailed by Warren during her White House bid, would levy a 2 percent annual tax on the portion of households and trusts valued between $50 million and $1 billion, with an additional 1 percent tax on any wealth beyond $1 billion.

It would affect the top 0.05 percent of taxpayers, or about 100,000 of the wealthiest U.S. households. University of California-Berkeley economists have estimated that it would generate $3 trillion in revenue over a decade — even more than they estimated during Warren’s presidential bid due to an economic downturn that has exacerbated income inequality and left ultra-wealthy individuals in even better financial shape.

The clean energy component of Biden’s Build Back Better plan has an estimated price tag of $2 trillion. The full implementation cost will depend on whether other components, such as Biden’s plans to support the caregiving workforce, are included and in what form.

The White House said last week that it did not expect to preview Build Back Better in detail until after the COVID-19 relief package is signed into law. Congressional Democrats aim to send the latest COVID-19 relief package to the White House by March 14, when previously passed unemployment benefits related to the pandemic expire. Press secretary Jen Psaki told reporters Monday that Biden “strongly believes the ultra-wealthy and corporations need to finally start paying their fair share.” She did not elaborate on what that might look like.

“Joe Biden is about to propose a multi-trillion Build Back Better plan that will likely need to be funded in significant part by taxing the rich,” said Adam Green with the Progressive Change Campaign Committee, which supports liberal candidates and policies.

“Putting this out before he proposes his Build Back Better plan is absolutely strategic and gives him a pay-for on a silver platter,” he added, referencing revenue-generating proposals lawmakers often pair with spending on social programs.

Jayapal said at Monday’s news conference that when you look at racial inequality as it relates to wealth and not just income it is “particularly staggering.” The wealth gap between White households as compared with Black and Latinx households left non-White households less able to weather the economic impacts of the COVID-19 pandemic. Boyle reiterated a point that Warren frequently made on the campaign trail to support the idea of a wealth tax: that the type of wealth held by most Americans — their house — is already taxed.

Polls consistently show that the public broadly supports the implementation of a wealth tax and it crosses ideological boundaries.

Democrats control the House and legislation there passes by a simple majority whereas in the evenly split, 100-seat Senate, most legislation, including a wealth tax or broader economic package, would likely require 60 votes.

Warren noted last month when she joined the Senate Finance Committee that the introduction of a bill to implement a wealth tax would be among her first moves. The proposal is also co-sponsored by Sens. Bernie Sanders of Vermont, Sheldon Whitehouse of Rhode Island, Jeff Merkley of Oregon, Kirsten Gillibrand of New York, Brian Schatz of Hawaii, Ed Markey of Massachusetts and Mazie Hirono of Hawaii, all Democrats.